The quest for a tennis racket.

You have likely heard (and read) the term “Shopping Experience” many times. This term can be quite generic if not made tangible. Using it without context is reckless, as it often confuses more than it contributes to the evolution of retail. In this article, I want to illustrate my own experience on a recent shopping journey.

My mission was simple: to buy a tennis racket for my wife. A relevant fact is that she has never played tennis. I have been playing the sport for years, albeit very amateurishly, and I am not a scholar of the subject. I play because it’s fun, good cardio exercise, fosters networking and has a low injury rate for my age group. Regarding my age, I prefer physical stores over e-commerce when choosing sports equipment. There are certainly thousands, if not millions, of tennis players with a profile like mine. This is a fundamental point for designing effective shopping journeys to generate good shopping experiences: knowing and clustering the consumer base.

Knowing Who Buys

Every business starts with the consumer to design brand and sales strategies. Under this aspect, it is necessary to understand what they think, how they think, how they behave, and what they value most. This is possible, for example, through data captured via relationship and reward programs. Another source of information is the crossing of ERP data with surveys at flow points. Public demographic data also helps, but it is less accurate, especially if the goal is to deepen knowledge about behavior in the specific category of the brand.

Experience in Practice

Returning to my expedition searching for a tennis racket, I chose Academy Sports + Outdoors, the closest sports equipment store to my house. The brand is local, super traditional (established in 1938), has 284 units, recently went public, and was listed on the Fortune 500 in 2021. In 2022, it grossed more than $6 billion. In short, it is a respectable brand with capital, access to a database, and a consolidated marketing structure, and it should know its customer base. But that does not seem to be the case. As a generic store in the segment, i.e., selling a little of everything, it naturally attracts more amateurs than professionals or high-level practitioners. For the most part, these audiences prefer specialized stores in search of specific equipment of higher value and performance and qualified service.

This point of being generic is fundamental to the design of experience within the Academy. The equation – amateur public, little knowledge, predisposition to pay less – becomes a matrix in the definitions of the flowchart (distribution of sectors and navigability), planogram (organization of products on shelves), and visual merchandising (from the furniture that displays products to visual stimuli that assist in attracting and converting sales).

My shopping decision tree was simple: price and brand. Based on these aspects, setting up a tennis racket display is easy. But that’s where things start to get complex. There are points, however, that make a difference for different levels of tennis players, such as racket head size, grip thickness, racket weight, string pattern, and material. A racket suitable for the style of play, skill level, and physical condition can make a difference in performance and injury prevention. But who knows this? Few. What is the role of the store? Inform the consumer in the simplest possible way at the time of purchase to guide them to a more accurate purchase. The benefits of a better-informed consumer are quite interesting for any retailer:

- buys more often because they return – loyalty.

- spends more, increases the average ticket – profitability.

What’s the twist? Not!

In the case of my experience at the Academy, I was not able to have these advantages. The images show that the tennis shelves were disorganized and had no clear classification order. The visual merchandising of the category was nonexistent, making information about brands, age groups, price ranges, and performance levels had to be “discovered” directly on the small product tags. Time also needs to be considered in the shopping experience. No consumer wants to waste time getting information about WHAT and HOW to buy. We are used to the filters of e-commerce, where we can do a very careful search to find what we need. Visual merchandising is the filter of physical stores. Organizing categories following the buying behavior of your largest customer base is a homework lesson. This is pending and not a trend, according to the wise Edmour Saiani.

The accessories category also lacks clarity. What is important? What should I buy? Which is the best product?

How can an inexperienced buyer understand which is the ideal ball if all products seem the same?

Como fazer o twist?

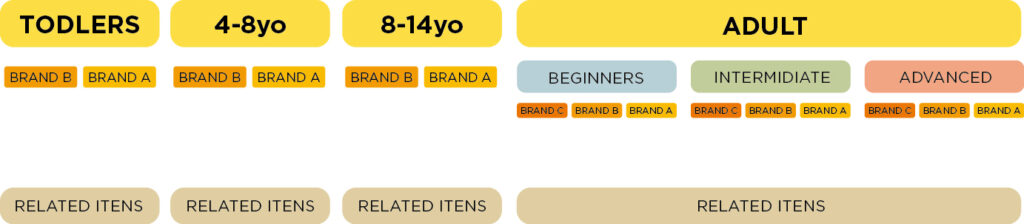

If I oversaw merchandising at the Academy, I would organize the tennis category as illustrated below.

I would also include communication highlighting the main points to consider when choosing the ideal racket. Organizing categories facilitates and speeds up the purchase decision, in addition to boosting linked sales. For example, positioning tennis balls for children right below the rackets for this age group would expand their visibility, consideration, and consequent conversion. Indicating specific grips with high sweat absorption power next to the rackets can also be a good strategy to instruct to sell. Products can and should be in their areas of origin (e.g., balls together with all other balls), but they can be moved close to related products to stimulate purchase, especially for amateur consumers and those with low involvement with the category.

Ultimately, the shopping experience comprises various elements that inform, clarify, assist, save time, and stimulate curiosity. And all of this doesn’t require high investments—just awareness and willingness.

Oh, and about the tennis racket for my wife? I didn’t buy it at Academy because I couldn’t find what I was looking for and received no assistance in the store. I bought it online instead. Then, they blamed Amazon for everything. What a twist.

These criticisms are not exclusive to Academy. I also visited Dick’s Sporting Goods and the experience was equally poor.